This decision is consistent with Treasury not accepting negative yields in Treasury nominal security auctions. Any CMT input points with negative yields will be reset to zero percent prior to use as inputs in the CMT derivation.

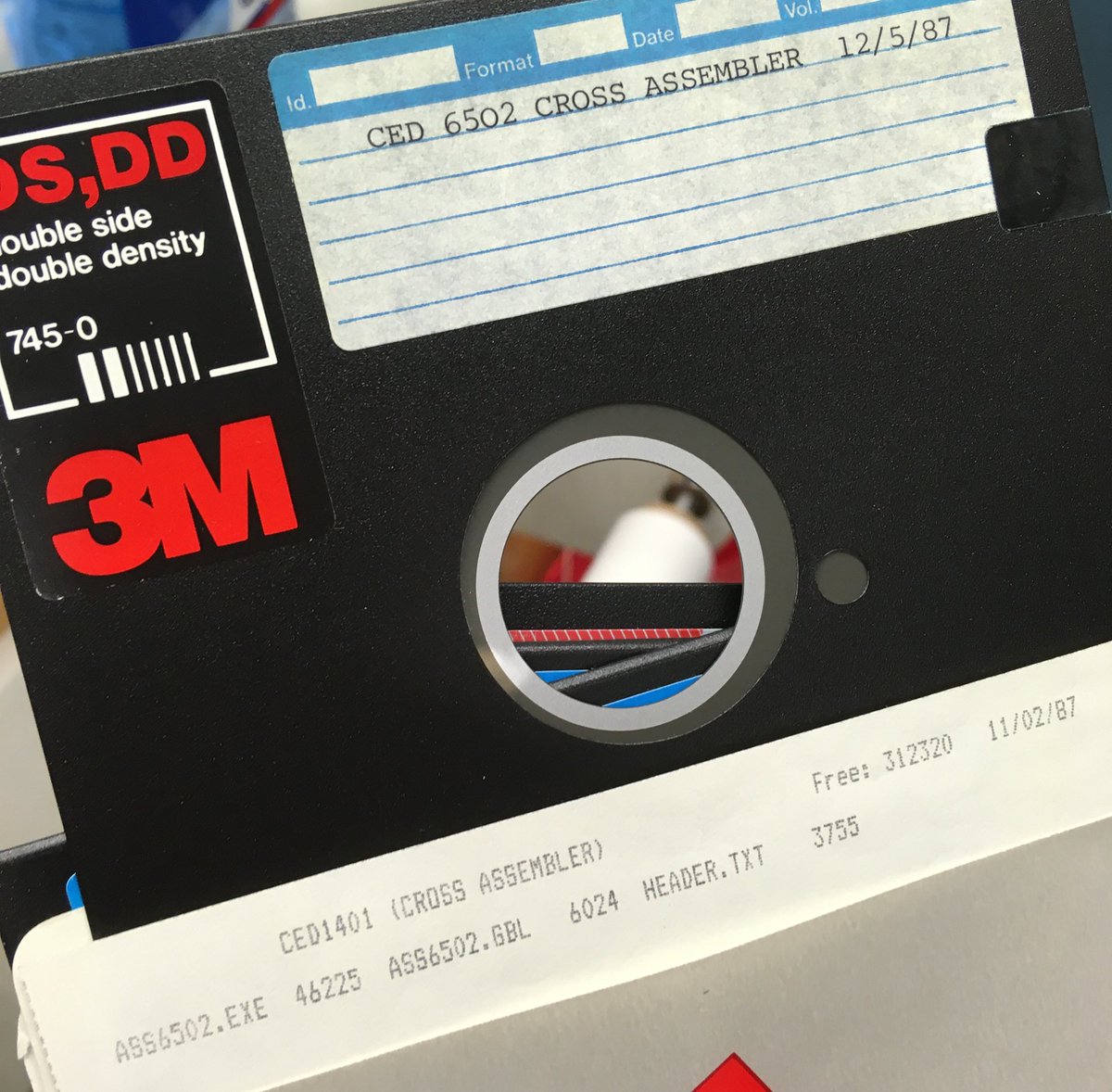

#SPIKE 2 CED FREE SERIES#

Negative yields for Treasury securities most often reflect highly technical factors in Treasury markets related to the cash and repurchase agreement markets, and are at times unrelated to the time value of money.Īt such times, Treasury will restrict the use of negative input yields for securities used in deriving interest rates for the Treasury nominal Constant Maturity Treasury series (CMTs). Negative Yields and Nominal Constant Maturity Treasury Series Rates (CMTs): At times, financial market conditions, in conjunction with extraordinary low levels of interest rates, may result in negative yields for some Treasury securities trading in the secondary market. See our Treasury Yield Curve Methodology page for details. Treasury reserves the option to make changes to the yield curve as appropriate and in its sole discretion. Inputs to the model are primarily indicative bid-side yields for on-the-run Treasury securities. Treasury Yield Curve Methodology: The Treasury yield curve is estimated daily using a cubic spline model. This method provides a yield for a 10 year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity. The CMT yield values are read from the yield curve at fixed maturities, currently 1, 2, 3 and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years.

These market yields are calculated from composites of indicative, bid-side market quotations (not actual transactions) obtained by the Federal Reserve Bank of New York at or near 3:30 PM each trading day. Currently available COVID-19 vaccines include messenger-RNA (mRNA) and recombinant adenoviral (AdV) vector vaccines, both encoding SARS-CoV-2 spike protein production as the primary target for neutralizing antibodies. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market. Accumulating evidence exists that COVID-19 vaccines might induce or exacerbate autoimmune rheumatic diseases. Yields are interpolated by the Treasury from the daily yield curve. Multichannel, continuous data acquisition and analysis package for stimulus generation, data capture, scrolling or triggered displays, control of external equipment, and custom analysis. Treasury Yield Curve Rates: These rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. As a result, there are no 20-year rates available for the time period Januthrough September 30, 1993. Treasury discontinued the 20-year constant maturity series at the end of calendar year 1986 and reinstated that series on October 1, 1993. See Long-Term Average Rate for more information. From Februto February 8, 2006, Treasury published alternatives to a 30-year rate.

* The 2-month constant maturity series begins on October 16, 2018, with the first auction of the 8-week Treasury bill.ģ0-year Treasury constant maturity series was discontinued on Februand reintroduced on February 9, 2006.

0 kommentar(er)

0 kommentar(er)